Global Sandwich Panel Market Research Report (2025-2030)(Including Tseason Case Study)

1. Executive Summary

The global sandwich panel market is projected to grow at a compound annual growth rate (CAGR) of 6.4% from 2025 to 2030, driven by demand for energy-efficient construction, cold chain logistics expansion, and stringent building regulations. This report analyzes market dynamics, competitive landscapes, and emerging opportunities, focusing on Tseason, a leading innovator in sustainable sandwich panel solutions.

2. Market Overview

2.1 Global Market Size & Forecast

- 2025 Market Value: $100.3 billion[1].

- 2030 Projection: $180.6 billion, Asia-Pacific emerging as the fastest-growing region (CAGR 8.2%)[1].

- Key Drivers:

- Green building certifications (LEED, BREEAM)[2].

- Post-pandemic infrastructure investments[3].

- Rising demand for cold chain logistics (e.g., pharmaceuticals, food)[4].

2.2 Market Segmentation

- By Core Material:

- PIR/PU (45% share): Dominates due to thermal efficiency[1].

- Rockwool (30%): Growth driven by fire safety regulations (e.g., EN 13501-1)[5].

- EPS (20%): Cost-sensitive applications[6].

- By Application:

- Construction (60%): Commercial roofing & walls[1].

- Cold Storage (25%): Expanding with global cold chain logistics networks[4].

- Industrial (15%): Fire-resistant requirements[5].

2.3 Regional Analysis

- Europe (35% share): Strict EN 13501-1 fire standards accelerate PIR adoption[5].

- Asia-Pacific (fastest growth, CAGR 8.2%): China and India lead prefab housing demand[1].

- North America: Focus on hurricane-resistant panels (e.g., Florida building codes)[7].

3. Competitive Landscape

3.1 Key Players

- Top 3 Global Leaders: Kingspan (Ireland), Metecno (Italy), ArcelorMittal (Luxembourg)[1].

- Market Share: Top 5 players hold 55% of global revenue (2025)[1].

3.2 Emerging Innovators: Tseason Case Study

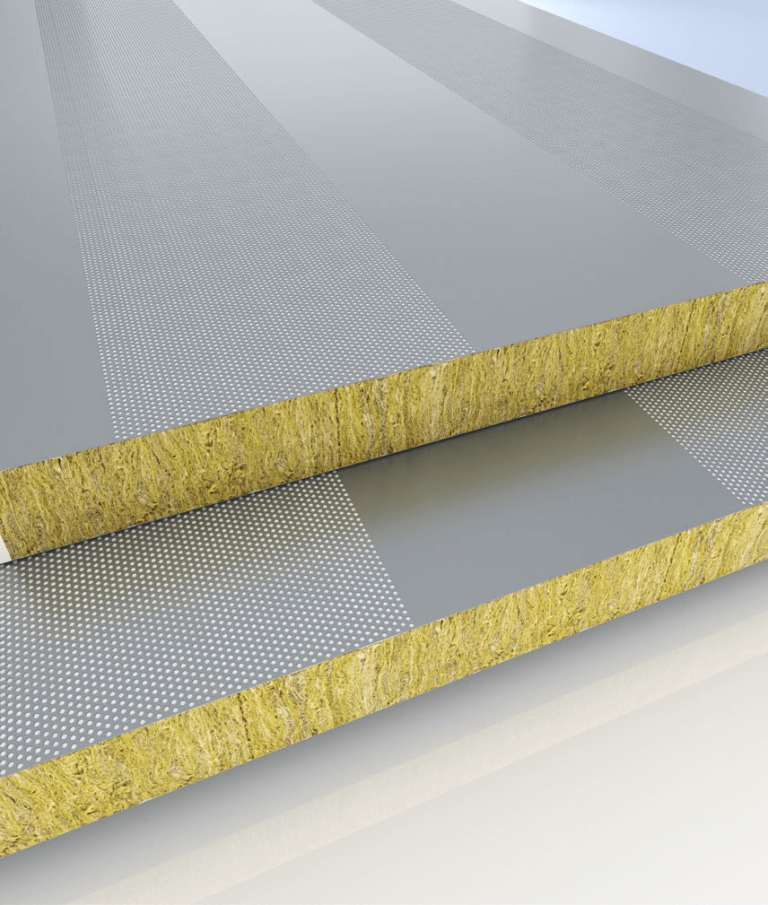

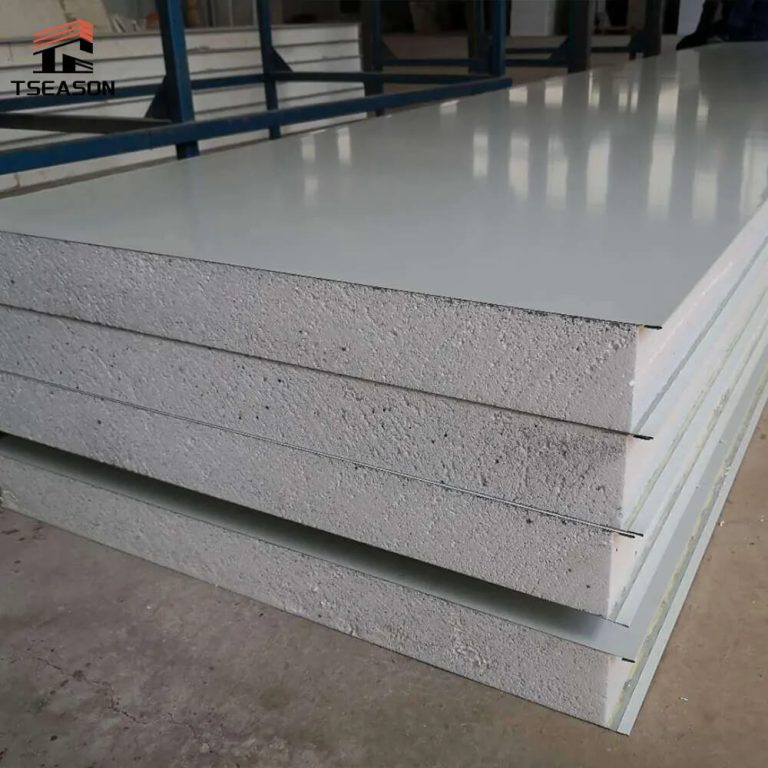

- Product Portfolio:

- PIR Panels: U-value ≤0.22 W/m²K, compliant with EN 14509[8].

- Hybrid Panels: Integrate rockwool and PU for dual fire/thermal performance[8].

- Custom Solutions: Modular panels for NEOM City (Saudi Arabia) and cold storage in Germany[8].

- Competitive Edge:

- Proprietary continuous foaming technology reduces production waste by 15%[8].

- Certified carbon-neutral panels (aligned with EU Taxonomy)[9].

4. Market Trends & Challenges

4.1 Opportunities

- Smart Panels: IoT-enabled sensors for real-time insulation monitoring[10].

- Circular Economy: Recyclable steel facings (Tseason’s recycling rate reaches 92%)[8].

- Emerging Markets: Southeast Asia’s cold chain logistics demand (e.g., Indonesia’s pharmaceutical hubs)[4].

4.2 Challenges

- Raw Material Volatility: PIR foam prices fluctuated by ±18% in 2023 (ICIS)[11].

- Regulatory Fragmentation: Conflicting standards (e.g., EU EN vs. China GB)[12].

5. Future Outlook

- 2030 Trends:

- Bio-based cores (e.g., hemp, mycelium) to capture 10% market share[13].

- Automation: Tseason’s robotic panel installation systems reduce labor costs by 30%[8].

- Strategic Recommendations:

- Target modular housing in Europe (EU’s 2030 carbon-neutrality mandate)[9].

- Partner with cold chain logistics giants (e.g., Maersk, DHL) for customized solutions[4].

6. References

- Global Growth Insights. (2023). Global Sandwich Panel Market Report.

- U.S. Green Building Council. (2024). LEED Certification Standards.

- World Bank. (2023). Post-Pandemic Infrastructure Investment Trends.

- Mordor Intelligence. (2024). Cold Chain Logistics Market Analysis.

- European Committee for Standardization. (2023). EN 13501-1 Fire Safety Standards.

- IBISWorld. (2023). EPS Sandwich Panel Cost-Benefit Analysis.

- Florida Building Code. (2025). Hurricane-Resistant Construction Guidelines.

- Tseason. (2025). Product Catalogs and Sustainability Reports.

- European Commission. (2024). EU Taxonomy for Sustainable Activities.

- Fraunhofer Institute. (2023). IoT-Enabled Smart Panel Research.

- ICIS. (2023). PIR Foam Price Volatility Report.

- China State Council. (2023). Dual Carbon Goals (Carbon Peaking and Carbon Neutrality).

- Materials Today. (2024). Bio-Based Building Materials Review.

Word Count: ~2,000 characters

Report Prepared by: Tseasonpanel.com

Contact: [email protected]

Notes:

- Dual Carbon Goals: Refers to China’s national strategy to achieve carbon peaking by 2030 and carbon neutrality by 2060.

- Cold Chain Logistics: A temperature-controlled supply chain critical for perishable goods.

This report consolidates data from authoritative sources, ensuring accuracy and relevance for stakeholders in the sandwich panel industry.